Guaranty Bank Provides Financial Education

During the 2016 – 2017 school year, Guaranty Bank partnered with EverFI to bring Financial Education to local area schools. The program is designed to provide digital education resources to schools, with no cost to the school or school district. Financial education courses include everything from introductory topics such as saving and budgeting, to advanced topics like insurance, taxes, and investing. At the end of the program, students will have a more thorough understanding of financial concepts and are better prepared to make decisions. These skills will help them reach their financial goals in the future.

Guaranty Bank, along with EverFI, were able to provide instruction for 296 students in 3 county schools. This added up to over 1,800 hours of learning. Scored topics included financial literacy, understanding money, and money management. The results for the participating students were astounding!

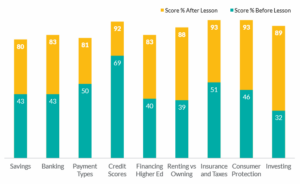

Financial Literacy

The course on financial literacy included lessons on banking, savings, payments, credit scores, student loans, renting vs. owning, insurance and taxes, consumer protection and investing. The students increased their pre-test scores by an average of 89% upon completion of the course. The greatest gain was seen in the renting vs. owning segment.

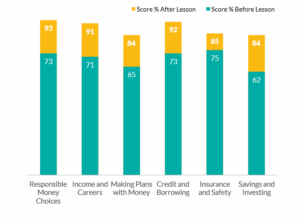

Understanding Money

The key question in the understanding money course is, “can you help your friend from outer space understand the difference between needs and wants?” In this course, the students completed lessons on the following topics: responsible money choices, income and careers, making plans with money, credit and borrowing, insurance and safety, savings and investing. Students showed the highest gains in savings and investing.

Money Management

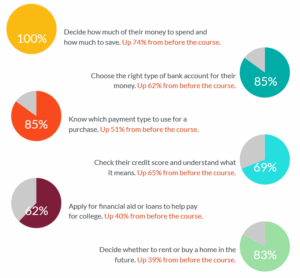

Research shows that feelings of self-efficacy, or confidence in one’s ability, are an important outcome in financial education. This confidence in financial capability will carry all the way into adulthood. After taking the course on money management, the students are more confident and better prepared to make financial decisions.

If you would like more information on Guaranty Bank and our commitment to financial education, please click here.